Above-, At-, Or Below-Market Pricing | In the ask size column, clicking below the current market price will add a sell stop order; Deliberately selling a product below its customary price, not to increase sales, but to attract customers attention in hopes that they will buy other products as well. Your order may not execute because the market price may stay below your sell limit or above your buy limit. Depending on your trading strategy, you a market order is the simplest of all order types. You cannot get in front of someone at a given price who is already in the order book.

In this example, the last trade price was roughly $139. Sometimes products are sold below cost to compete with other competitors. A limit order buys a stock at (or below) a specific price you target, or sells a stock at (or. Use the table below to learn about the different order types available. These orders are executed at a specific price or better after a stop price is reached.

Notice how the red line is below the current price. If you place a sell stop order here, in order for it to be triggered, the current price would have to continue to fall. The purchaser of the put option) the right to sell an asset (the underlying), at a specified price (the strike), by (or at) a specified date (the expiry or maturity) to the writer (i.e. A market order is an order to buy or sell a security immediately. Use the table below to learn about the different order types available. If i try to compete at those prices, i will go out of business. These orders are executed at a specific price or better after a stop price is reached. In this example, the last trade price was roughly $139. He immediately sells the shares at the current market price of $35 per share. Pricing below a competitor's costs occurs in many competitive markets and generally does not violate the antitrust laws. Setting a market price for a product or product class based on a subjective feel for the competitors' price or market as the benchmark. If a market is at its equilibrium price and quantity, then it has no. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility.

This order tells the market that you will buy 100 shares of xyz, but under no circumstances will you pay more than $33.45 per share for the stock. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. Price of goods or products are decided according to prevailing market condition. A minimum price is when the government don't allow prices to go below a certain level. In the ask size column, clicking below the current market price will add a sell stop order;

In the ask size column, clicking below the current market price will add a sell stop order; Can prices ever be too low? the short answer is yes, but not very often. Above, at, or below market pricing. Log in or create a free account to get started. Market on close is another option, but is less common. Pricing below a competitor's costs occurs in many competitive markets and generally does not violate the antitrust laws. In connection with price determination, industries do enjoy some discretion in setting the prices of their products above or below the cost of. Choose this type to buy or sell a security such as a stock that will be executed immediately at the best price currently available on the market. Use the table below to learn about the different order types available. Summing the total unit cost of providing a product or service and adding a specific amount to the cost to arrive at a price. Your limit order to buy xyz at $33.45 per share won't be filled above that price, but it can be filled below that. We call this an excess supply or a surplus. Loss2profit.the account with zerodha or angel broking using below link i will pay you 100 rs cash (once.please check with your personal financial expert before investing or trading in stock/share market.

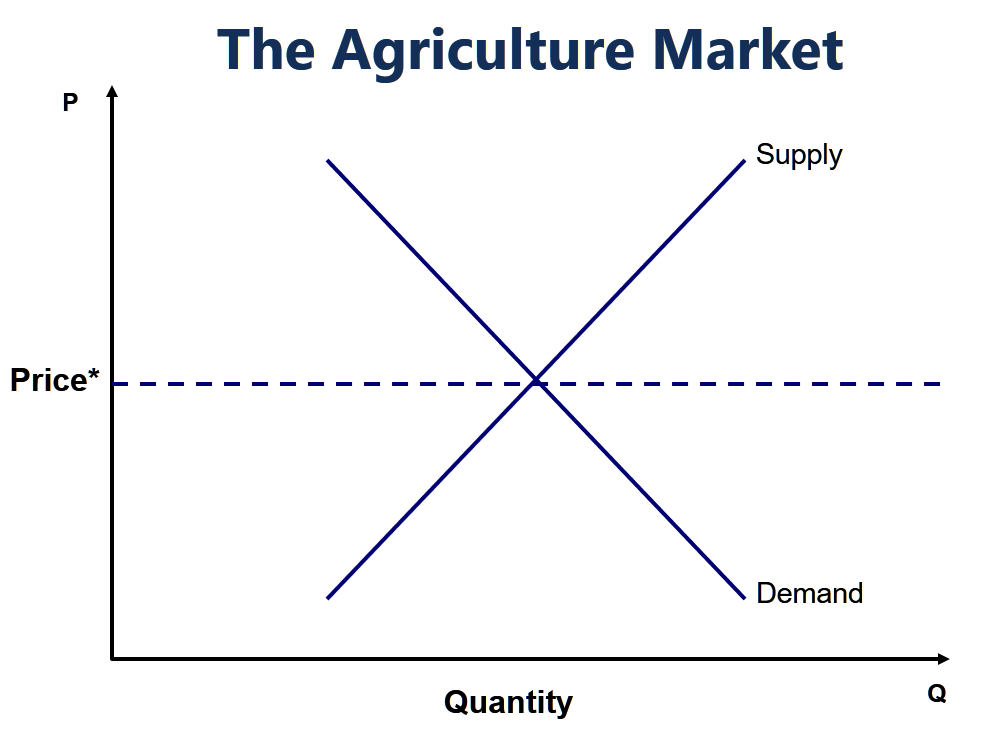

In this example, the last trade price was roughly $139. The image below will the above the market order execution type is a very convenient way to trade the markets, when you. A market order is an order to buy or sell a security immediately. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. Now suppose that the price is below its equilibrium level at $1.20 per gallon, as the dashed horizontal line at this price in figure 3 shows.

In this example, the last trade price was roughly $139. A sell stop order is entered at a stop price below the current market price; We call this an excess supply or a surplus. A limit order to sell at a price above the current market price will be executed at a price equal to or more than the specific price. The relationship between the strike create your watchlist to save your favorite quotes on nasdaq.com. A price above equilibrium creates a surplus. Log in or create a free account to get started. Notice how the red line is below the current price. In finance, a put or put option is a financial market derivative instrument which gives the holder (i.e. This type of order guarantees that the order will be executed, but does not guarantee the a buy stop order is entered at a stop price above the current market price. If there are other orders at your limit, there may not be enough shares available to fill your order. These orders are executed at a specific price or better after a stop price is reached. At this price, the quantity demanded is 500 gallons, and the quantity of gasoline supplied is equilibrium is important to create both a balanced market and an efficient market.

Above-, At-, Or Below-Market Pricing: This order tells the market that you will buy 100 shares of xyz, but under no circumstances will you pay more than $33.45 per share for the stock.

No comments

Post a Comment